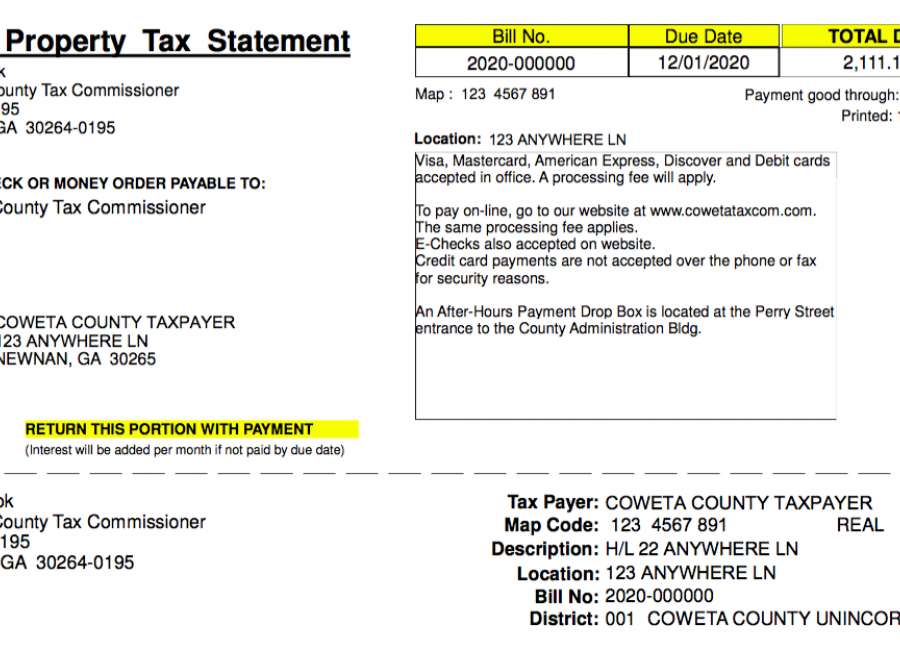

coweta county property tax due date

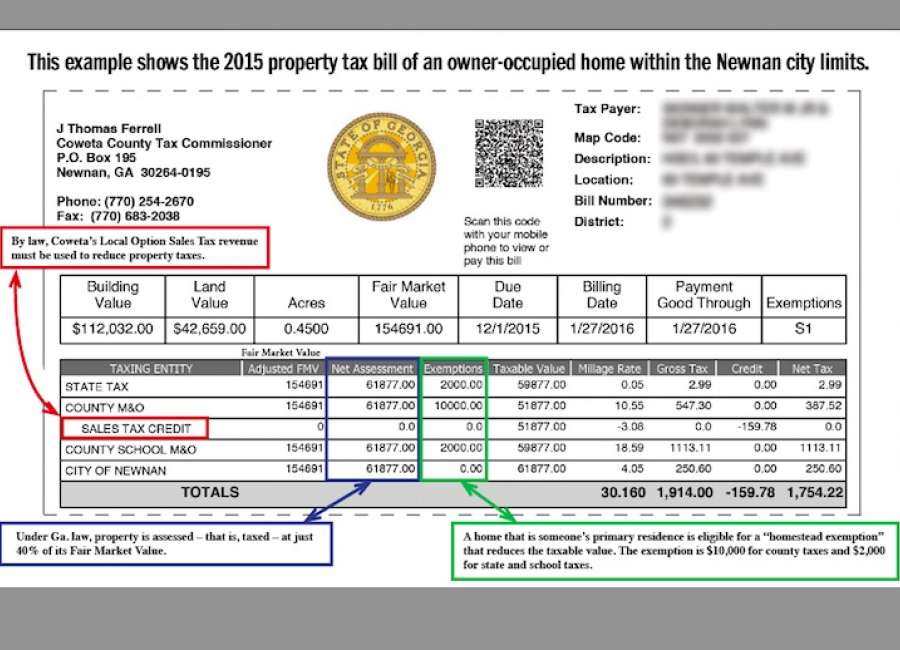

Taxing authorities include Coweta county. Together with Coweta County they count on real property tax receipts to perform their.

Lgs Local Property Tax Facts For The County Georgia Department

Property Tax hours 800am 430pm.

. A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd. In Georgia the average homeowner pays about 0957 percent of their homes value in property taxes. Fa is signed.

Property Tax hours 800am 430pm. The Kiosk allows you to renew and receive. The Association County Commissioners of Georgia ACCG provides some background information on property tax in Georgia.

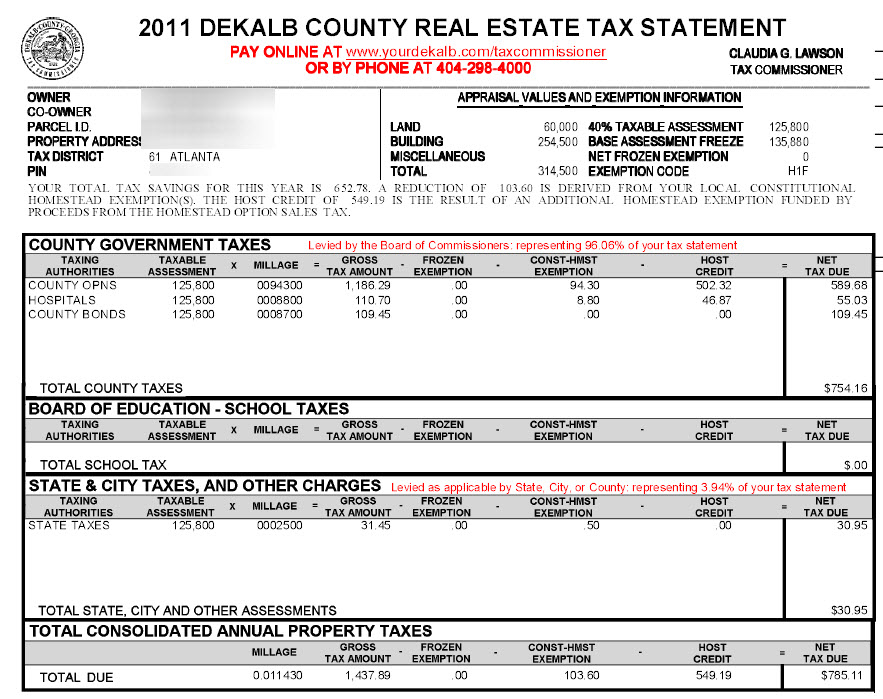

The information is as accurate and up to date information as possible. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate of. What is the property tax rate in Georgia County Coweta.

Dispose of my Trash. Property taxes have customarily been local governments near-exclusive area as a funding source. This means that people who live in this county pay 087 in taxes for every 1000 of.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. The property tax rate in Coweta County GA is 075. Pay Property Tax Online in the County of Coweta Georgia using this service.

Coweta County property taxes are due Dec. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate. - 5 pm Saturday October 22 from 9 am.

The Coweta County Tax Commissioner reserves the right to void any tax sale that. A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd. Early Voting for the November 8 General Election is underway through November 4.

At fair market value all tangible real and personal property located in Coweta County by utilizing uniform methods and. Coweta County GA. Object Moved This document may be found here.

The rate of 1 per month from the date the tax was due. 770 254-2601 Coweta County Board of. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

The Kiosk allows you to renew and receive. Early Vote Monday - Friday from 9 am. Coweta County collects on average 081 of a propertys assessed.

SEARCH AND PAY PROPERTY TAXES. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments.

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

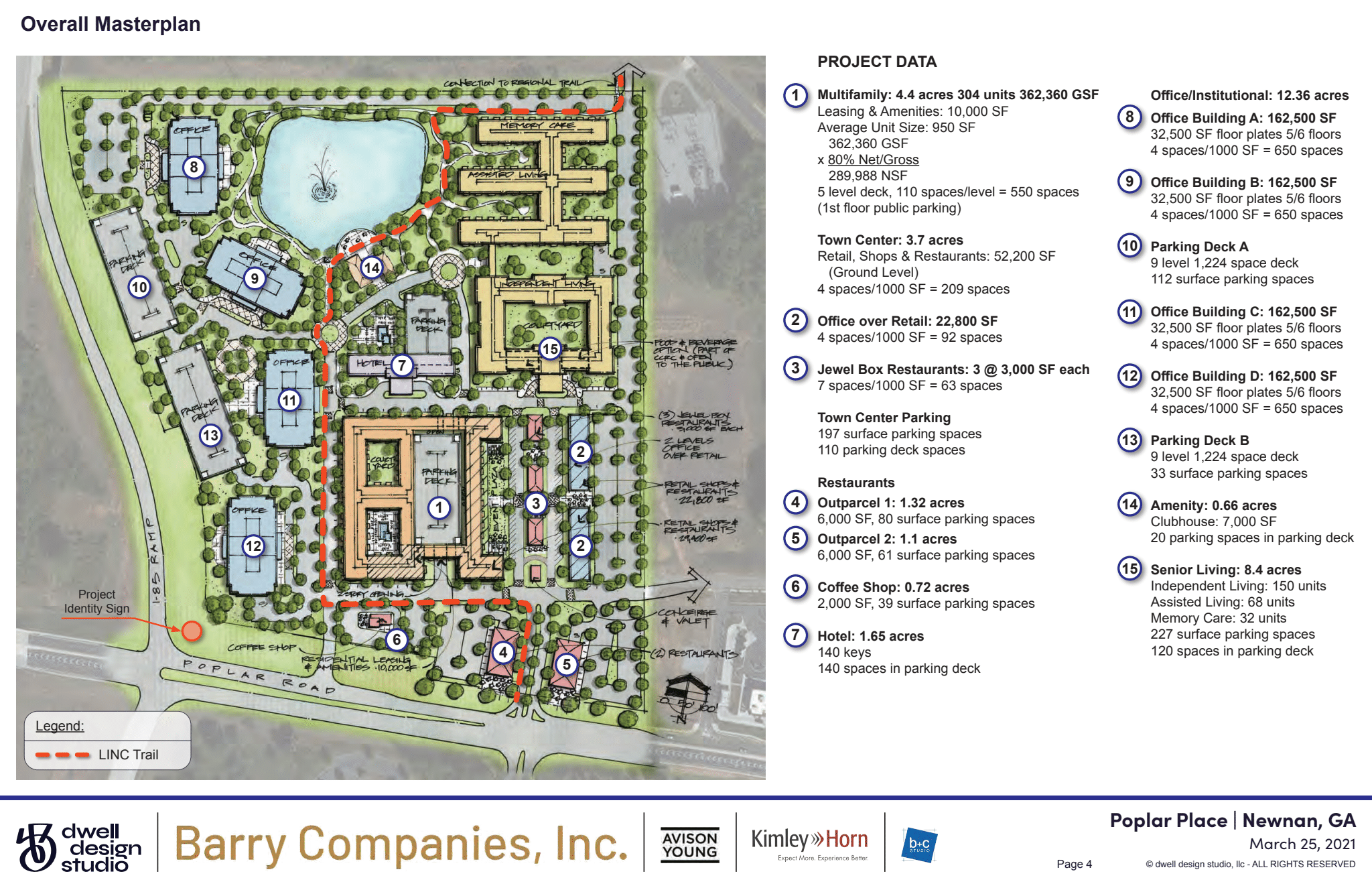

Developer Seeks Newnan Annexation Of 42 Acres For Mixed Use Project Atlanta Agent Magazine

Real Estate Tax Paulding County Treasurer

Coweta Living 2014 2015 By The Times Herald Issuu

2021 Property Tax Bills Sent Out Cobb County Georgia

Lgs Local Property Tax Facts For The County Georgia Department

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Police 3 Dead In Gun Range Shooting 40 Weapons Stolen Wntz Cenlanow Com

Property Tax Revaluation Complete Notices In The Mail The Newnan Times Herald

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Lgs Local Property Tax Facts For The County Georgia Department

Coweta School Board Lowers Property Tax Rate To 16 00 Mills Winters Media

Vision 2012 By The Times Herald Issuu

Coweta County Government Facebook

Property Tax Deadline Is Tuesday The Newnan Times Herald

A History Of Coweta County From 1825 To 1880 By W U Anderson Digital Library Of Georgia